Tds Quarterly Return Filing Date

However the maximum fees that you will have to pay will be limited to the tds amount.

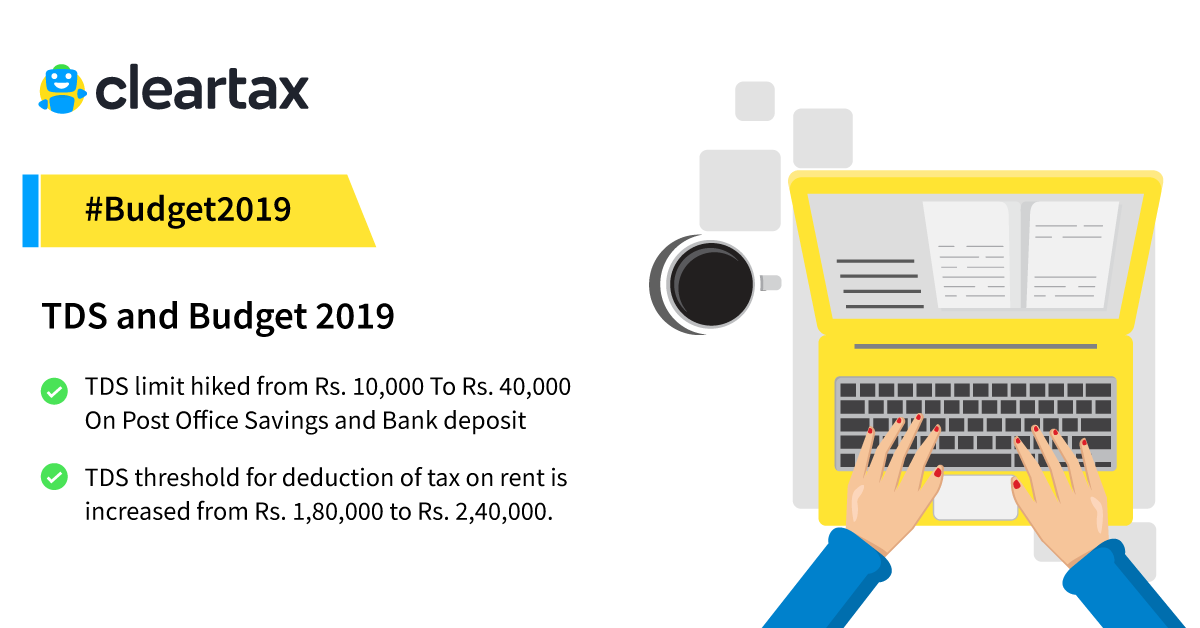

Tds quarterly return filing date. However as advised by income tax department acceptance of tds tcs statements prior to the fy 2007 08 has been discontinued at tin. Quarterly statement of tds deposited for the quarter ending june 30 2020. There is a lot of confusion among the deductors regarding the filing of tds returns for the first quarter of the financial year fy 2020 21 that ended on june 30 2020. As per the income tax act if any person makes a payment to the receiver then tds is required to be deducted at a prescribed rate and then deposited with the government.

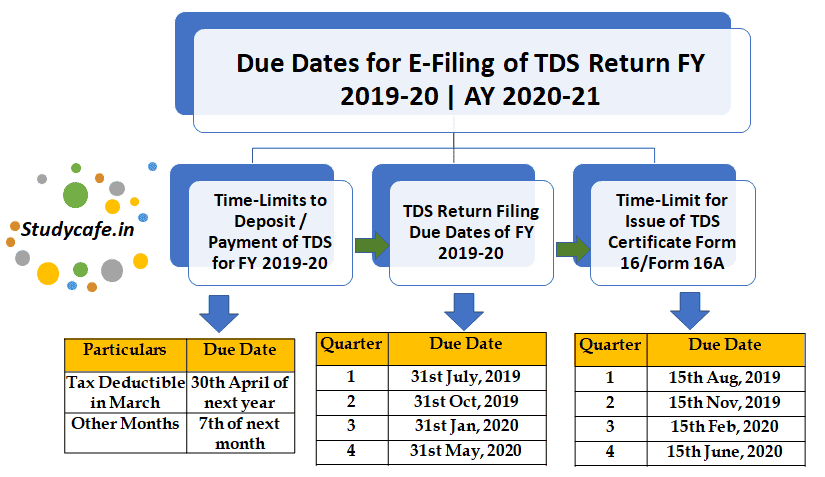

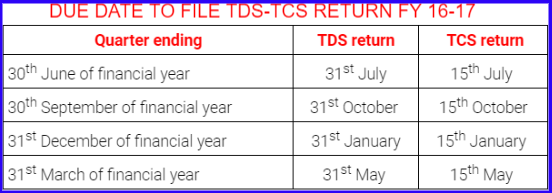

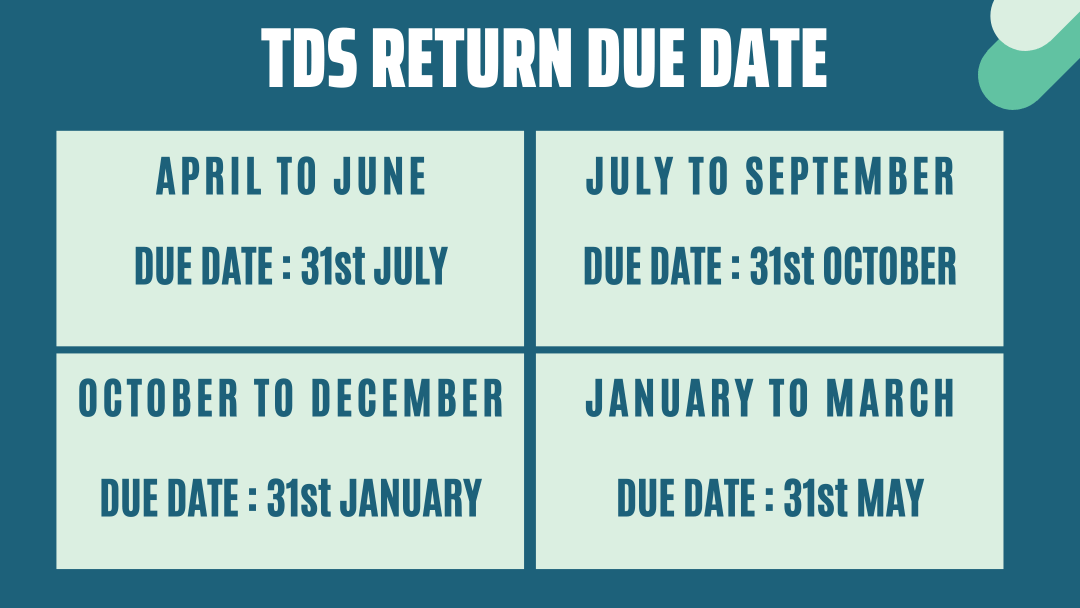

Get to know the tds return due dates and tcs return due dates with last dates for filing for ay 2020 21 fy 2019 20. How to download due dates. In case an assessee does. The following utility can be used to prepare quarterly regular as well as correction statements.

Income tax department of india modified file formats in relation to tds and tcs statements. Quarterly return of non deduction of tax at source by a banking company from interest. Find tds return due dates and tcs return due dates with the time period and last date for filing for ay 2020 21 fy 2019 20. Annexure i is the regular quarterly data for the months of january to march.

Tds stands for tax deduction at source while the tcs stands for tax collected at source. As per the gazetted notification issued by govt. Of india all due dates prescribed or notified under the income tax act which will falls during the period 20 th march 2020 to 29 th june 2020 has been extended to 30 th june 2020. 07 may 2020 it is contained in the ordinance dt.

An assessee is liable to file e tds return if tds is deducted from his her income. Based on the above notification the due date of filing tds tcs returns for quarter ending march 2020 has been extended till 30 th june 2020. The due date for filing of return has been extended from july 31 2020 to november 30 2020 vide the taxation and other laws relaxation of certain provisions ordinance 2020 read with notification no 35 2020 dated 24 06 2020. Form 24q salary tds return in the fourth quarter q4 includes two annexures annexure i and annexure ii.

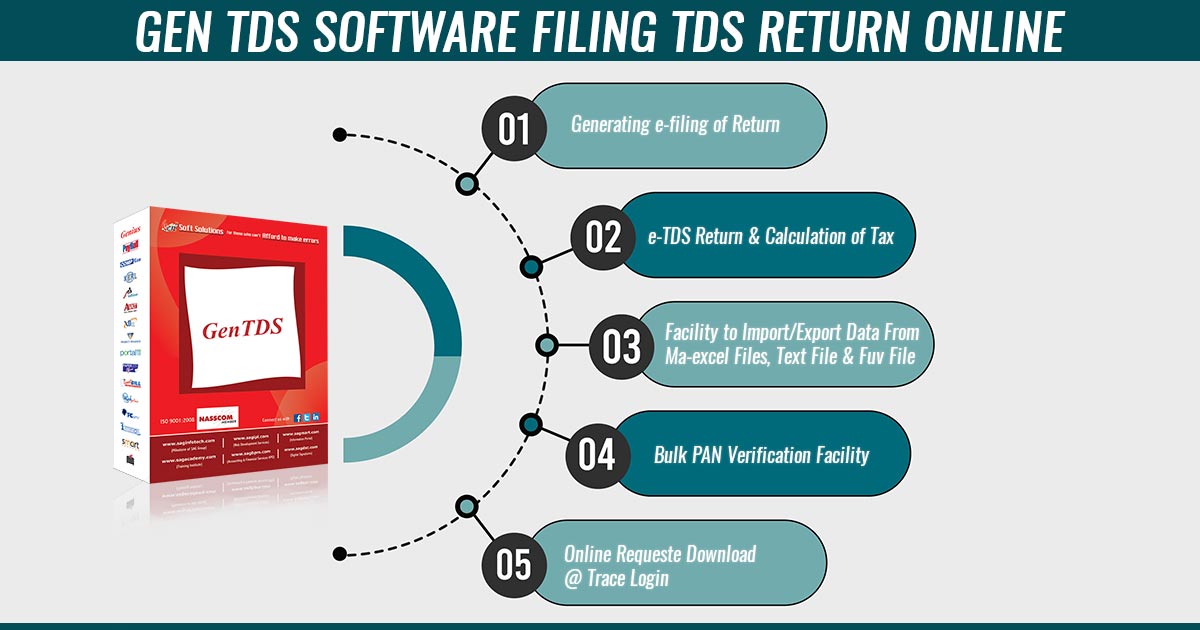

New e tds tcs return preparation utility ver. From financial year 2005 06 onwards tds tcs statements have to be filed on quarterly basis. Rpu for quarterly returns. Is there any extension to tds return due date for quarter 1 fy 2020 21.

It is obligatory to file tds return within the due date mentioned above. As per the ordinance passed by the government on 31 march 2020 where the due date for filing of any appeal reply or application or furnishing of any report document return statement or such other record by whatever name called under the provisions of the specified act falls during the period from the 20 march 2020 to 29 june. This article analyzes whether there is any extension in due date in furnishing the tds statement for the 1st quarter of the financial year or it is the. The fee will be charged for every day after the due date until the date on which your return is filed.

Annexure ii is the tax computation calculation information for each employee along with summary and tax deduction for the whole financial year this would determination if any tax is due or needs to. Failure to file your tds returns within the due date will mean that you will be subject to a late filing fee of rs 200 per day.