Tds Rate Chart In Hindi

Normal slab rate new reduced slab rate.

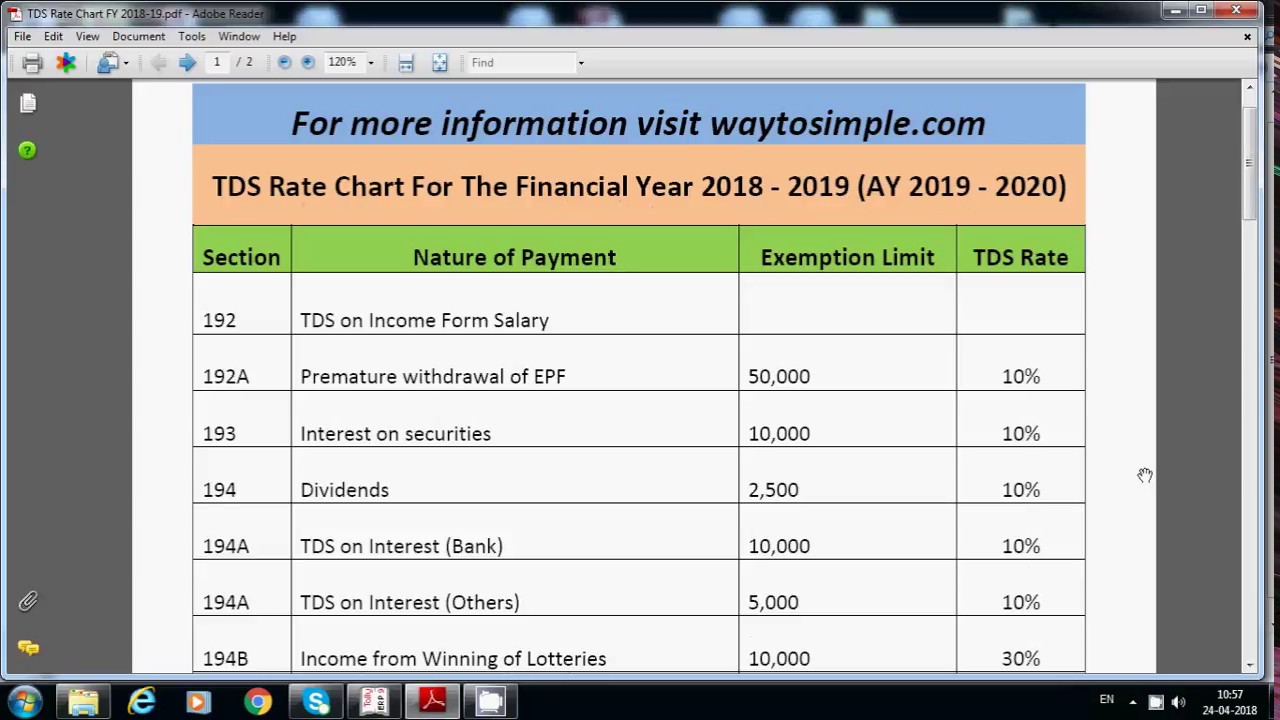

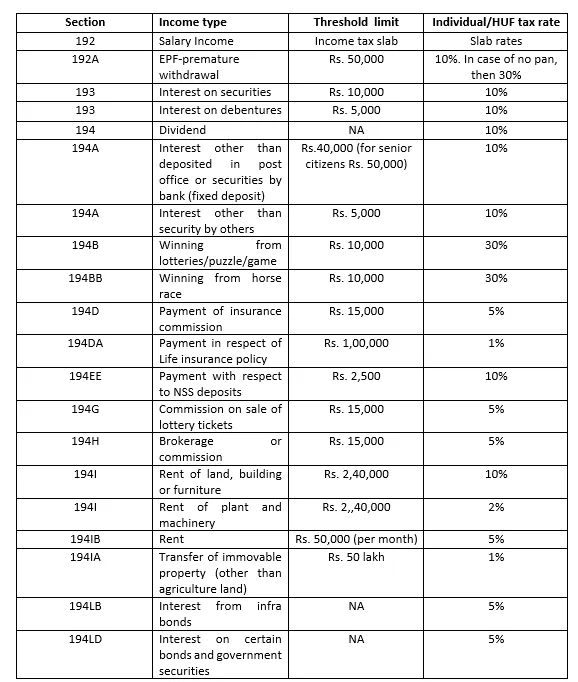

Tds rate chart in hindi. However you can use ro water purifiers to reduce tds level below 500. Check out the tds rate chart for 2020 21. In that press release she declared that the tds rates for all non salaried payment to residents and tax collected at source rate will be reduced by 25 percent of the specified rates for the remaining period of fy 2020 21. Tds rate chart for assessment year 2021 22 financial year 2020 21 as we all are aware that yesterday our honourable finance minister has conducted press release.

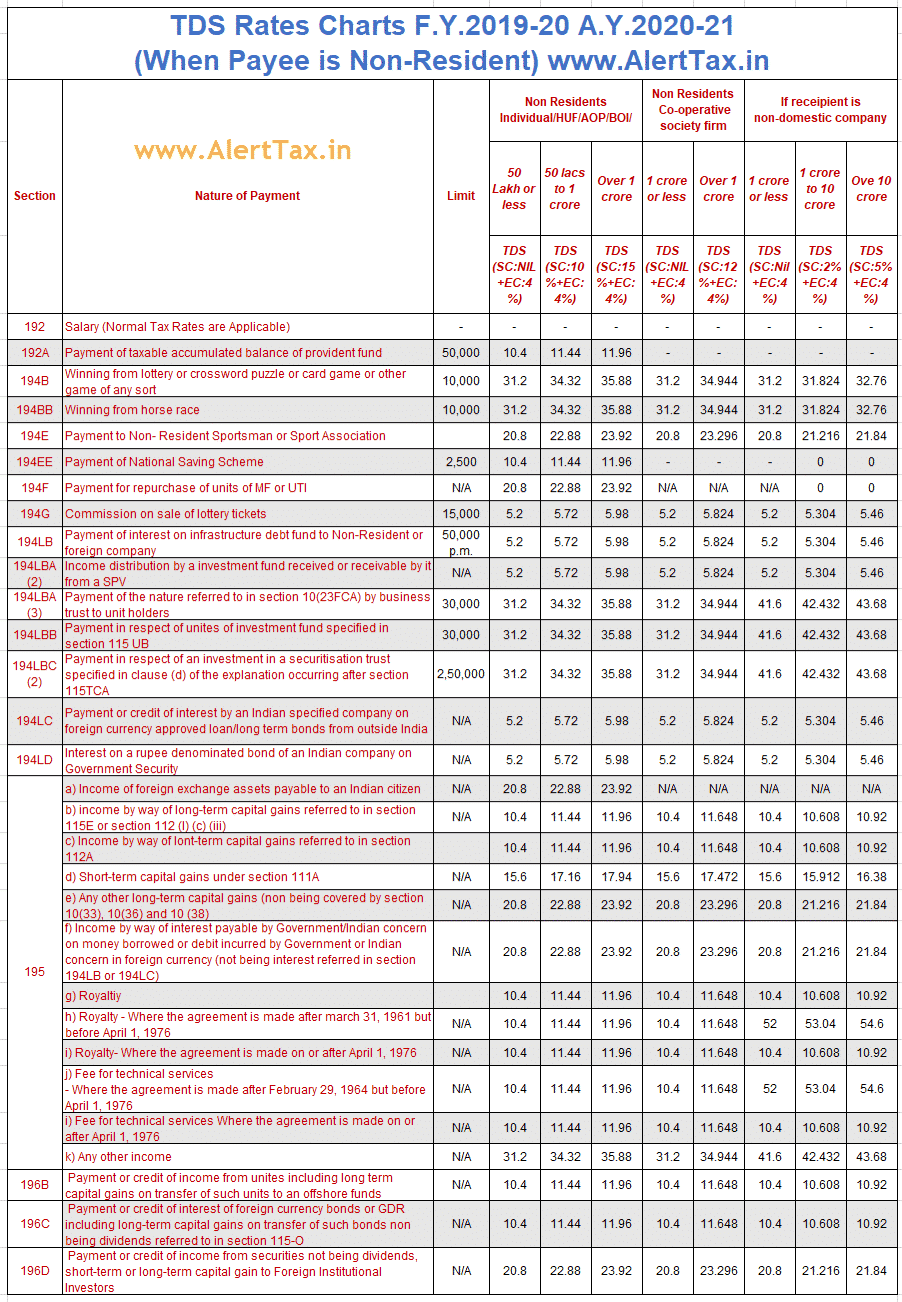

1 1 where the person is resident in india section 192. Union minister of finance corporate affairs smt. Tds 3 tds rate chart tax deducted at source in hindi by the accounts subscribe the accountant my another youtube channel for full accounting course tally excel word ppt https www. The tds rates to be applicable on income for the current year is updated in the tds rates chart for fy 2020 21.

Tds rates in 1. Any level below 500 mg litre is acceptable for drinking. Many places in india have this level of tds. Water is not fit for.

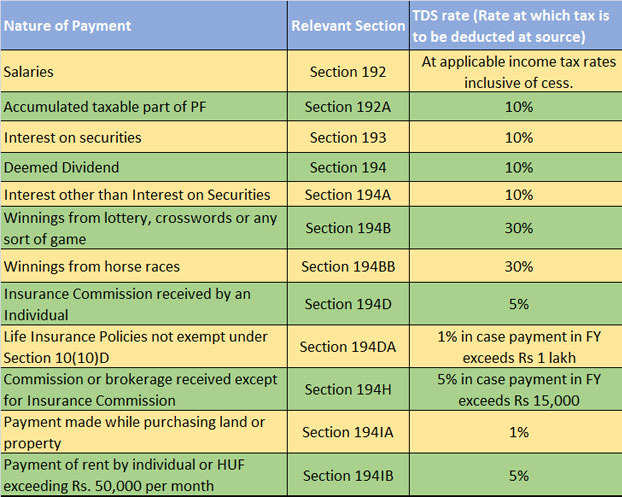

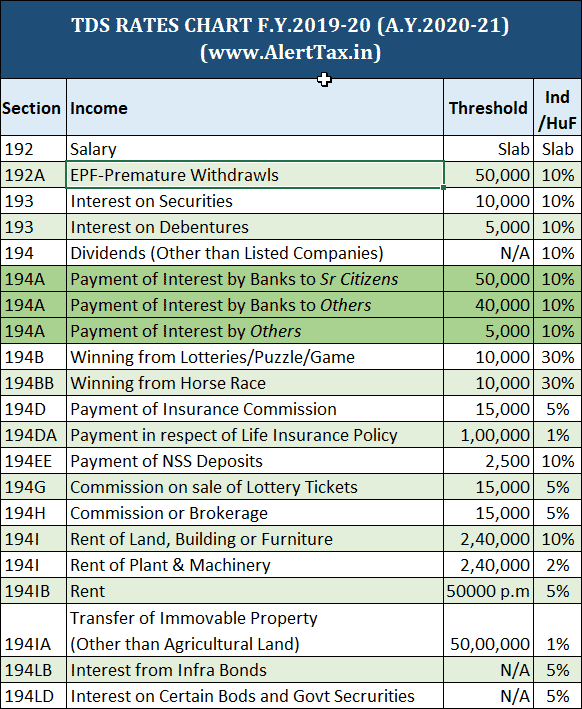

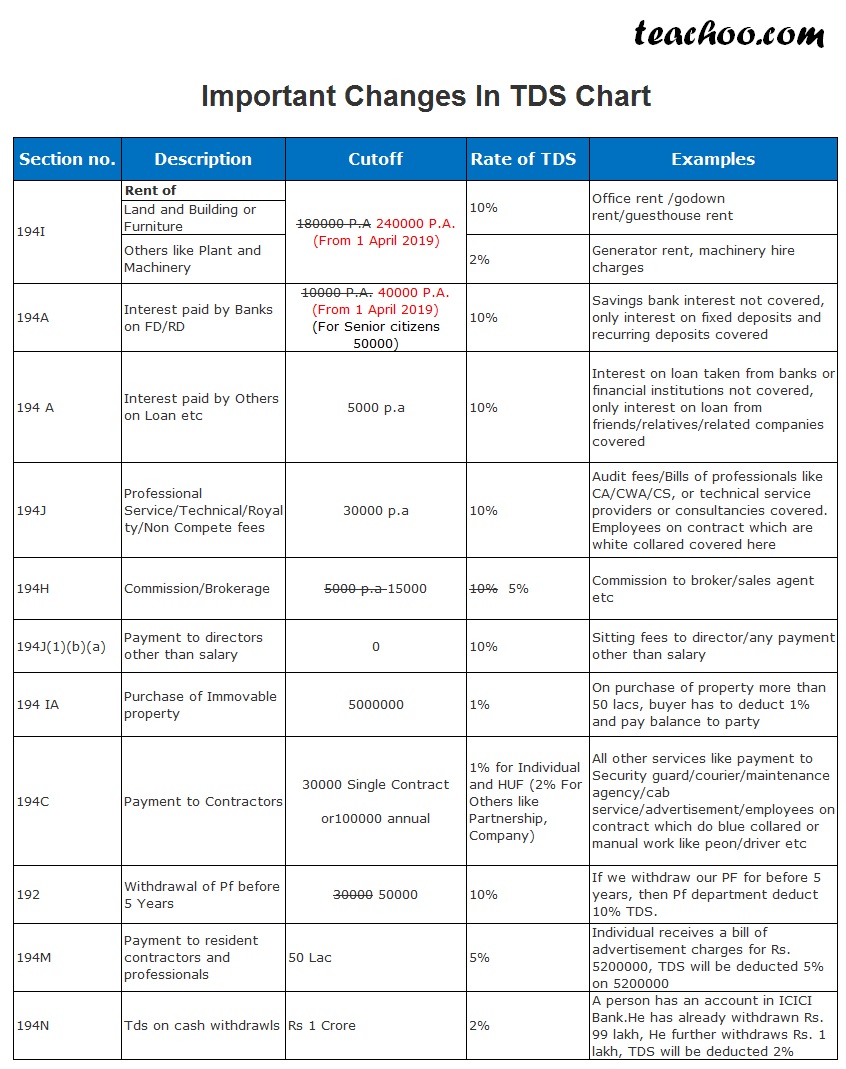

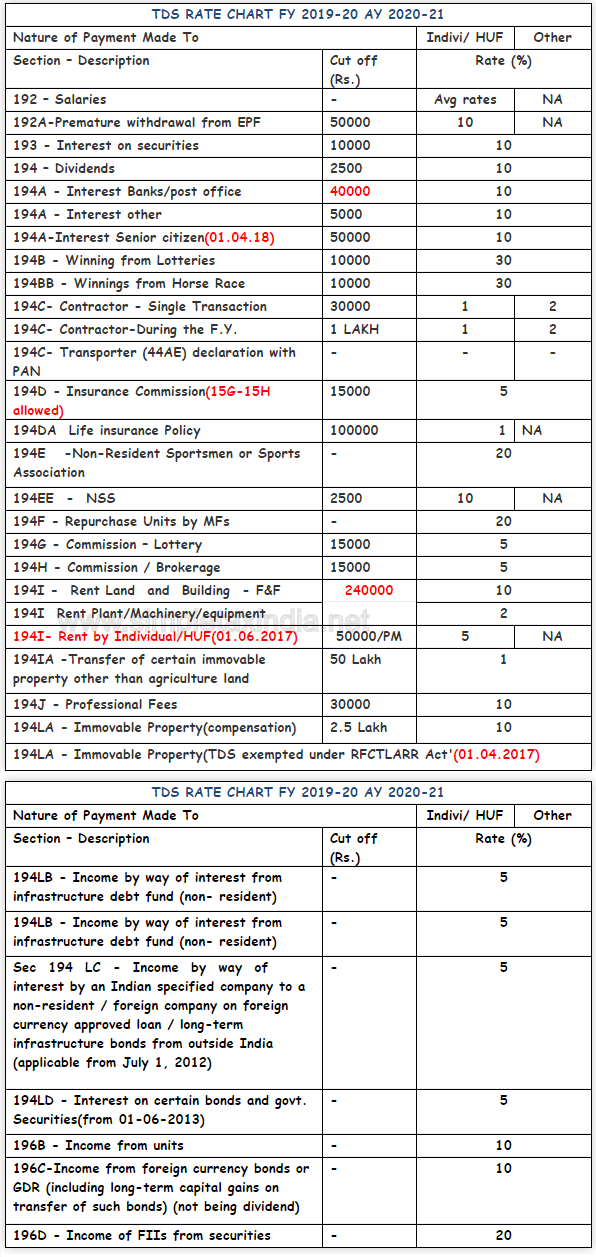

Interest on securities a any debentures or securities for money issued by or on behalf of any local authority. Revised tds tcs rate applicable as per covid economic relief package applicable for all kinds of payments w e f. Payment of accumulated balance of provident fund which is taxable in the hands of an employee monetary limit rs 50 000 10. Tds in this range is generally not acceptable for drinking.

Tds rates in ay 2020 21 tds rates in ay 2021 22 1 where the person is resident in india section 192. Tds rate chart for ay 2020 21 w e f 14 05 2020 reduced by 25 tcs rates for fy 2019 20 excel pdf format download in excel formata and in pdf format. What is tds in hindi tds kya hai tds ka full form और ट ड एस क य क ट ज त ह व tds क र फ ड प र स स क य ह स लर पर ट ड एस tds meaning in hindi. The tds rate on income depends on the salary of an individual and based on that it ranges between 10 to 30.

In the case of a person other than a company. Tds stands for tax deducted at source. It is an indirect way of collecting income tax at source by the government of india. Nirmala sitharaman has announced today reduction in rates of tax deduction at source tds and tax collected at source tcs.