Tds Return Filing Date

The due date for filing of return of income under section 139 has been extended to july 31 2020 vide the taxation and other laws relaxation of certain provisions ordinance 2020 read with notification no.

Tds return filing date. Also we mention quarterly and annual tds tcs return due dates. According to section234e if an assessee fails to file his her tds return before the due date a penalty of rs 200 per day shall be paid by the assessee until the time the default continues. 7 th of next month. Form 24q form 26q form 27q and form 27eq are the same and as follows.

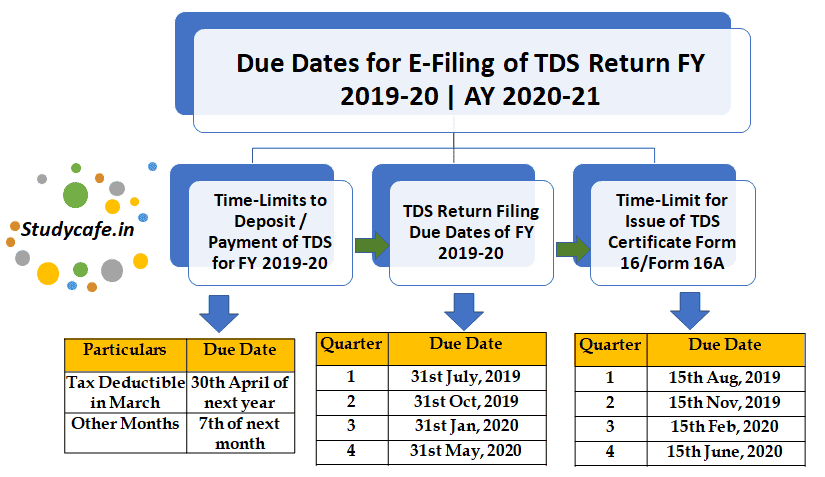

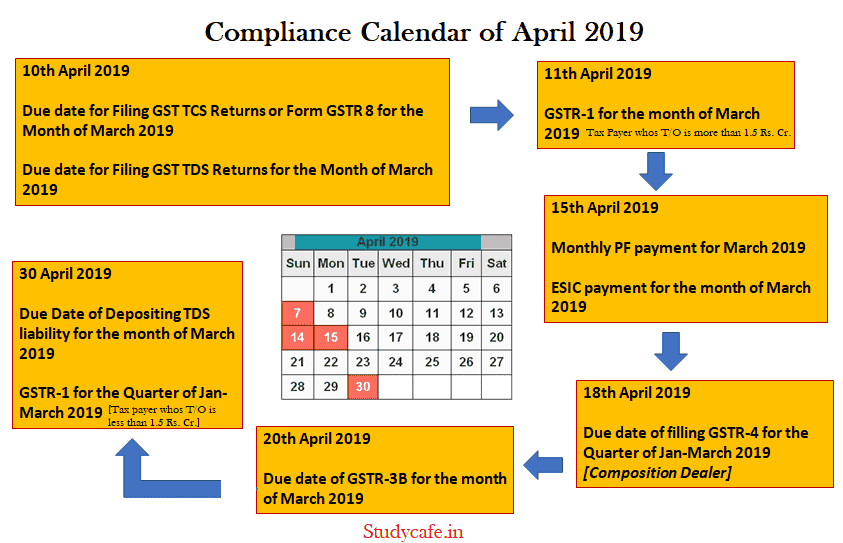

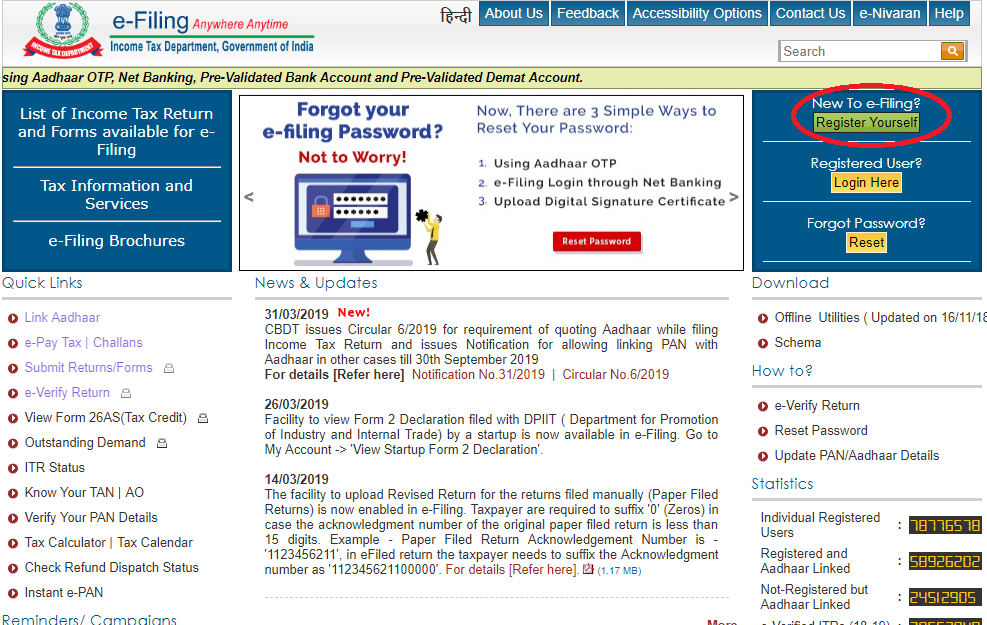

Due date of tds deposit for fy 19 20 ay 20 21. The last date for furnishing tds and tcs check out the details of tds tcs return e filing in ay 2020 21 fy 2019 20. 07 may 2020 it is contained in the ordinance dt. Due dates for filing tds returns.

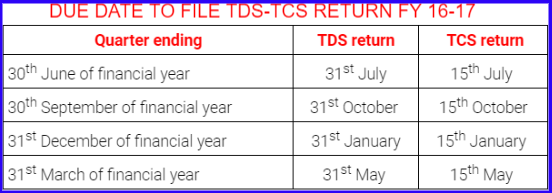

The due dates for filing of statement of tcs tds for the quarter ending march 31 2020 have been extended to july 31. In any other case. Tax on perquisites opted to be deposited by the employer. 24q 26q 27q.

It is to be noted that the original date for filing was 15 th may for tcs and 31 st may 2020 for tds. Read more has been extended by the department till 31st july 2020. The due dates for all the tds returns i e. Where tax is deducted by the office of the government.

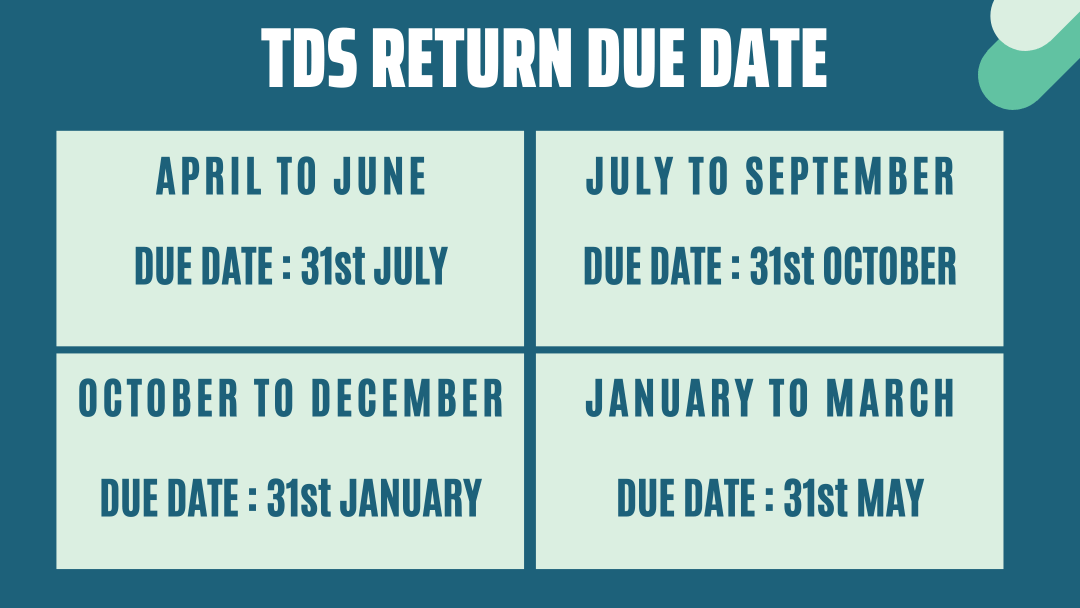

Quarter period last date of filing 1st quarter 1st april to 30th june 31st july 2019. If an assessee has not filed the return within 1 year from the due date of filing return or if a person has furnished. Due dates for. Interest rate for tds payment.

Based on the above notification the due date of filing tds tcs returns for quarter ending march 2020 has been extended till 30 th june 2020. View full year calendar. 35 2020 dated 24 06 2020. However the total penalty should not exceed the tds amount.

Tax deposited with challan. Due dates for e filing of tds tcs return fy 2019 20 ay 2020 21. The interest and late filing fees if any have been paid to the government s credit. Due dates for filing of tds returns are as below.

Check out the details of tds tcs return e filing in ay 2020 21 fy 2019 20. Banks deduct a tds if interest income on a bank fixed deposit is more than rs 10 000. Non filing of tds return. Due dates to submit form 15g 15h.

As per the ordinance passed by the government on 31 march 2020 where the due date for filing of any appeal reply or application or furnishing of any report document return statement or such other record by whatever name called under the provisions of the specified act falls during the period from the 20 march 2020 to 29 june. 7 th of next month. Subject to extension by the cbdt for specific quarters of a particular fy quarter form no.